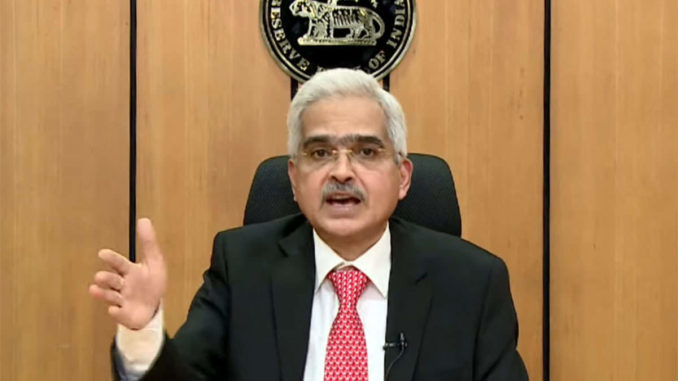

New Delhi: The Reserve Bank of India has kept the policy rates unchanged at 4%. The apex bank’s governor Shaktikanta Das said that RBI has successfully navigated its way through choppy seas. With the outbreak of the European war, we are faced with new and enormous obstacles. The European Union’s conflict has the potential to disrupt the global economy.

The six-member Monetary Policy Committee (MPC) of the Reserve Bank of India (RBI), led by RBI Governor Shaktikanta Das, decided unanimously to hold the repo rate at 4%. The MPC committee maintains the reverse repo rate at 3.35 percent.

Governor Das stated that the global economy has undergone a tectonic upheaval.

“Strong buffers, such as big forex reserves, significant improvement in external indicators, and banking sector strengthening, have reassured us during the last few years. We at the RBI are resolute and ready to steer the economy out of the current quagmire,” said Das.

The predicted benefits of the ebbing of Omicron have been outweighed by the geopolitical circumstances since the last meeting. Introduce a Standing Deposit Facility that will serve as the foundation for the Liquidity Adjustment Facility corridor. Global inflation projections have risen, raising the potential of a significant impact on global output across regions. Cost pressures and supply chain disruptions are likely to persist, said RBI governor.

On bank rates, RBI governor Das said that MSF and Bank rates have also remained steady.

RBI governor further said that in order to prevent fraud, cardless cash withdrawals will be available via UPI at all bank branches and ATMs. Propose guidelines for such operators to secure payment systems.

Bureau Report

Leave a Reply