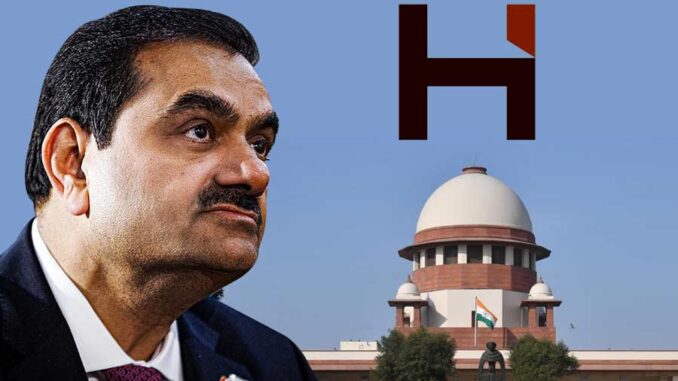

NewDelhi: The Supreme Court of India delivered the much-awaited verdict on the Adani-Hinderburg controversy, months after a batch of pleas were filed seeking a probe into the matter.

A three-judge bench headed by Chief Justice D.Y. Chandrachud and Justices J.B. Pardiwala and Manoj Misra, hearing the case said that there was no ground to transfer the case from Sebi to SIT, and directed Sebi to go ahead with its probe as per the provision of the law. SC added that facts of case do not warrant transfer of probe to SIT or other agency.

The SC has directed the SEBI to complete its probe into two pending cases relating to allegations against the Adani group in three months’ time. A bench headed by Chief Justice D Y Chandrachud noted that SEBI has completed its probe in 22 out of 24 cases relating to allegations against the Adani group, and held that it cannot regulate SEBI’s power of investigation.

Meanwhile, reacting to the court judgement, Billionaire Gautam Adani has reacted saying truth has prevailed – ‘Satyameva Jayate’. Adani has also expressed his gratitude towards people who stood by him and the company during the crisis. He wrote on X:

The apex court had reserved its verdict in the case in November last year on PILs, filed by lawyers Vishal Tiwari, M L Sharma, Congress leader Jaya Thakur, and Anamika Jaiswal.

Chief Justice Chandrachud had conveyed dissatisfaction regarding the petitioners’ reliance on information sourced from entities such as the Organized Crime and Corruption Reporting Project (OCCRP) and Hindenburg Research. He emphasized the court’s necessity to depend on Indian investigative agencies for credible information.

The controversial Hindenburg Research’s report, had alleged that the Adani Group of companies has manipulated its share prices, involved in fraudulent transactions, leading which the company’s stocks witnessed a bloodbath in the Indian stock markets.

Bureau Report

Leave a Reply