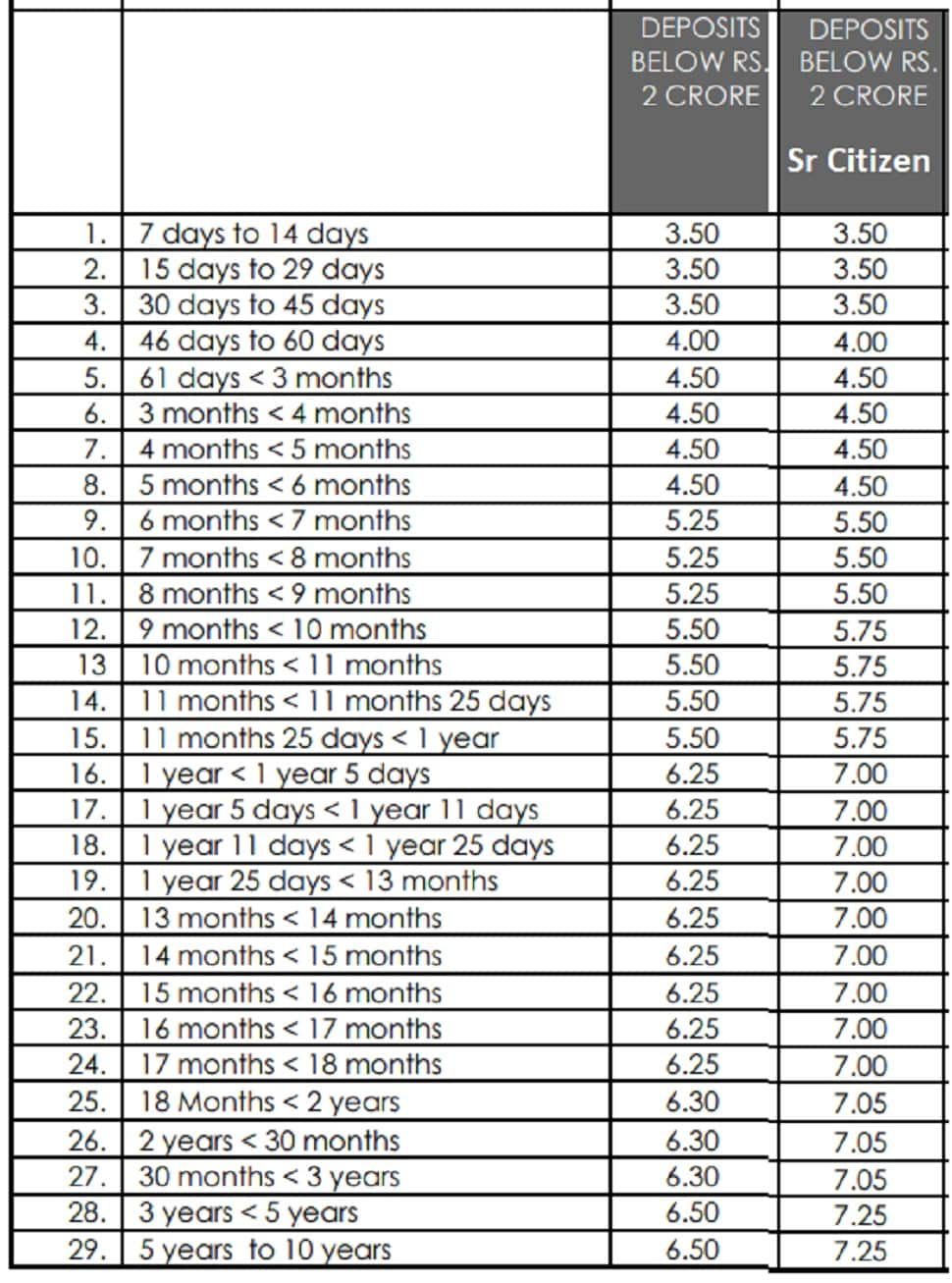

NewDelhi: Private sector lender Axis Bank has hiked its fixed deposit rates with effect from November 5 for fixed deposits below Rs 2 crore. The bank has revised its FD rates across multiple tenures of deposits ranging from 46 days to 10 years and the maximum hike has been by up to 115bps. The minimum interest rate for deposits below Rs 2 crore now stands at 3.50 per cent while the maximum is 6.50 per cent for the general public. For senior citizens, the minimum interest rate is 3.50 per cent and the maximum is 7.25 per cent, thus bringing it at par with several other lenders.

Axis Bank FD Interest Rates 2022

Axis Bank is now offering an interest rate of 3.5 per cent for fixed deposits maturing in 7 days to 45 days and 4 per cent for deposits maturing in 46 days to 60 days. The Axis Bank fixed deposits maturing in 61 days to less than 6 months will now earn an interest of 4.5 per cent, and fixed deposits with a tenure of 6 months to less than 9 months will get an interest of 5.25 per cent. Fixed deposits maturing in 9 months to less than one year is earning an interest of 5.5 per cent while deposits for one year and less than one year and 18 months will earn an interest of 6.25 per cent.

Axis Bank is offering an interest rate of 6.3 per cent for fixed deposits between 18 months and less than 3 years while those for 3 years to 10 years tenure will get 6.5 per cent return. For senior citizens, the bank is offering a return of 7 per cent on deposits maturing in 1 year to less than 18 months while 7.05 per cent for deposits maturing between 18 months to less than three years. Senior citizen fixed deposits with a tenure of 3 years to 10 years will earn an interest of 7.25 per cent.

Axis Bank FD interest rate 2022 return calculator for senior citizens

If you are a senior citizen and want to invest Rs 2 lakhs with the Axis Bank for a tenure of one year, you will earn in the interest of Rs 14,372 at the rate of 7 per cent and the maturity amount will be Rs 2,14,372. If you invest this for 3 years, you will earn a return of Rs 48,109 at the rate of 7.25 per cent and the maturity amount will be Rs 2,48,109. If you invest this amount for five years, the return will be Rs 86,452 and the maturity amount will be Rs 2,86,452.

Bureau Report

Leave a Reply